When potential customers search for your business online are they getting the right information?

Large majorities of internet users research purchases online before buying products or services in the real world, whether from an independent business or a multi-location enterprise. A recent consumer survey found that nearly 70% of adults conduct internet research “every time” or “almost every time” before making a purchase. And for those in the 18 – 35 age range, the number rises to more than 80%. Online research before buying offline is the rule rather than the exception.

Businesses both small and large therefore need to provide accurate (and complete) information online to help consumers make decisions. Bad or missing data will deter or inhibit buying. If users encounter missing or inaccurate information, such as a bad address or incorrect phone number, a meaningful percentage will look for an alternative provider or merchant. That could represent significant missed revenue opportunities.

According to the U.S. Census Bureau, 60% of local business information is out of date within 24 months and one in five business records change annually. While the business itself is the ultimate source of truth, there are numerous third-party sources, aggregators and intermediaries that capture and syndicate information across a complex online system of companies and sites. That creates complexity – and sometimes chaos!

To remedy that, major platform like Google and Facebook have all sought to enable business owners to directly manage listings. This is not enough, however, because of the profusion of business data across the internet, resulting in inconsistencies, inaccuracies and duplicates. In turn, bad or outdated information can result in frustrated customers, lower search engine visibility, and lost sales. Furthermore, the process of correcting local business listings and related data, is far from a “set it and forget it process.” It requires ongoing monitoring and effort.

Searches for local business information frequently turn into purchases. That’s because local searches carry higher levels of intent—the dentist’s phone number, the restaurant location, retail store hours and so on—than general research queries. The user is seeking a specific business or to choose among several competitors in a category (e.g., best pizza in St. Louis).

The types of local business data and information that consumers routinely seek include:

- Business address/location

- Directions

- Hours

- Reviews

- Contact information/phone number

- Pricing information

- Coupons and promotions

- Payment information

After this research, the consumer purchase typically happens offline. Roughly 90% of retail transactions and an even higher percentage of service-related purchases take place offline. Combined, this represents trillions in annual consumer spending. There’s a great deal at stake in getting local search right. And bad local business data may cause a substantial percentage of ready-to-buy consumers to “move on” to another company

or provider.

Bad Data Hurts the Bottom Line

In 2018, BrightLocal published findings from a survey of just over 1,000 US adults. It asked some similar questions and found a larger number of people (41%) would abandon the search for a particular business or seek a competitor if address information online was wrong.

How common is the perception or experience of inaccurate online business information? Very common according to the same BrightLocal survey. Among the difficulties and disappointments people have experienced in the past 12 months are the following:

- Called a wrong number – 36%

- Saw incorrect or incomplete information online for a local business – 30%

- Visited a business that didn’t have the product/service represented online – 25%

- Arrived either too early or late due to incorrect hours information online – 24%

- Found different information for the same business on multiple sites – 24%

- Visited the wrong location because of a bad address – 22%

In the aggregate, 71% of these survey respondents said incorrect local business information online resulted in a poor experience. And 93% agreed with the statement: Finding incorrect information in online directories frustrates me. The fact that these numbers are so large suggests that incorrect or missing data is the rule rather than the exception.

A large percentage of consumers in the survey were more likely to blame the business than the online directory where the incorrect information appeared. Asked who was at fault for the bad business data, 31% said the business; 18% blamed the online directory. Just over half would assign blame equally. On the other side of the equation, according to a 2017 study by Ipsos MORI, accurate and complete local listings are:

- 2.7 times more likely to be considered reputable

- 3.6 times more likely to be well liked

- 1.7 times more likely to be considered for purchase

The Local Data Ecosystem

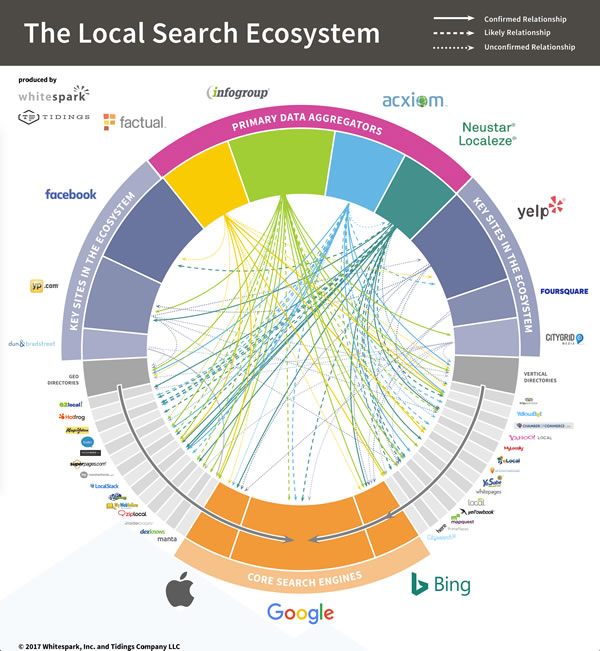

The graphic below illustrates how local business data flows and passes from one source to another within the “local search ecosystem”, from major aggregators (Neustar Localeze, Infogroup, Acxiom and Factual), to search engines social sites, review sites and directories.

In the graphic, Google is like the sun at the center of a data solar system. More than any other publisher it ingests and processes data from multiple sources including its own Google Business Profiles. As the Google index is regularly refreshed, old data is overwritten by new data, which may replace accurate listings with inaccuracies. This is why local data must be continuously monitored—and the more locations, the more complex the process.

There are numerous sources of local listings data:

- Telephone records/directory assistance databases

- Scanned print directories

- Web-crawling

- Crowd-sourcing

- Trade publications

- Government sources

- Point-of-sale data

- Data aggregators

These sources are the primary and secondary local data providers. Indeed, many secondary databases are constructed from the combination of multiple “primary” sources. Those secondary sources (i.e., data aggregators) try to normalize and clean the data, then sell/syndicate it to consumer sites and apps. The combining and circulation of data often transmit errors to publishers downstream where consumers encounter them.

To combat this, some publishers (including Google) turned to crowdsourcing with “suggest an edit” capabilities. Crowdsourcing can remedy some data problems, but it can also introduce others. People who know little about a business may edit content or make additions that could impact consumer perceptions and behavior – not always for the better. On occasion, malicious competitors try to harm rivals using these crowdsourcing tools. On Facebook, for example, anyone can create an unofficial page for any business location. This can result in multiple pages for the same business. Small businesses without monitoring tools may not be aware those pages exist. They can also take on a life of their own as people add comments and reviews and those unofficial pages start showing up in Google results for branded or navigational searches.

Conclusion: Listing Accuracy Is Mandatory

In case it’s not abundantly clear, accurate business data isn’t a luxury. It’s mandatory! As the survey data make clear, inaccurate online information risks frustrating or alienating potential customers. Nearly 80% of BrightLocal survey respondents said that “Finding incorrect information in online directories would stop me from using a local business.”

Local information is a key feature of mobile search, which is now the dominant way people find information and content online. And listings management is a foundational component of Digital Marketing. Beyond this, there are direct, financial consequences of not getting it right.

It’s strange that local data accuracy remains such a challenge today. That’s partly a function of the way that local business data is complied, interpreted and presented by search engines

and directories.

Advances in machine learning and AI promise that in the near future we won’t be having this same conversation about listings accuracy. Until that time, however, the ongoing and critical work of local data correction continues.